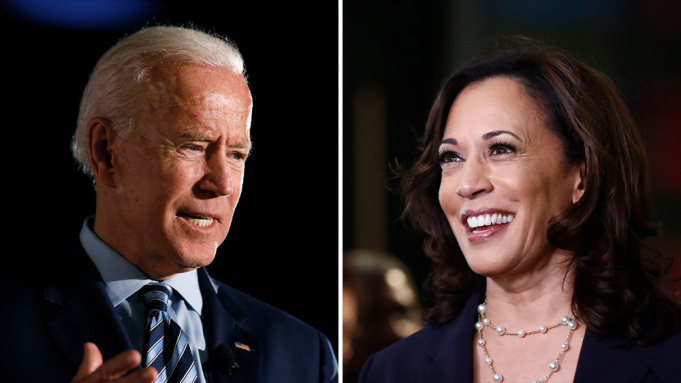

In order to lower the cost of child care, lower the cost of prescription drugs, and address the climate crises with investments in clean energy, a new report from The New York Times details the Biden-Harris Administration’s push to make sure big corporations and the top 1 percent pay their fair share.

According to a recent White House analysis, the wealthiest 400 households in America, “pay an effective federal income tax rate of just over 8 percent per year” — significantly lower than the average American household.

President Biden and congressional Democrats’ Build Back Better agenda will correct our broken tax system by rewarding work, not wealth with one of the largest middle-class tax cuts in history paid for by those at the top. By creating an economy and tax code that gives working families a fair shot, Democrats can invest in the communities that built this country and show the American people that their government works for them.

The New York Times: In Push to Tax the Rich, White House Spotlights Billionaires’ Tax Rates

By: Jim Tankersley | September 23, 2021

Key Points:

- “President Biden is leaning into his push to increase taxes on the rich as he seeks to unify Democrats in the House and Senate behind a $3.5 trillion bill that would expand federal efforts to fight climate change, reduce the cost of child care, expand educational access, reduce poverty and more.”

- “‘I’m sick and tired of the super-wealthy and giant corporations not paying their fair share in taxes,’ Mr. Biden wrote on Twitter on Wednesday, amplifying an argument that Democratic strategists believe will help sell his economic agenda to the public and potentially lift the party’s candidates in midterm elections. ‘It’s time for it to change.’”

- “To buttress that argument, White House economists published on Thursday a new analysis that seeks to show a gap between the tax rate that everyday Americans face and what the richest owe on their vast holdings.”

- “The analysis suggests that the wealthiest 400 households in America — those with net worth ranging between $2.1 billion and $160 billion — pay an effective federal income tax rate of just over 8 percent per year on average.”

- “Mr. Biden has proposed changing both those tax treatments. He would raise the capital gains rate to match the rate paid on wage income. And he would eliminate the stepped-up basis provision for wealthy heirs.”

Read the full report here.

###

Published: Sep 23, 2021