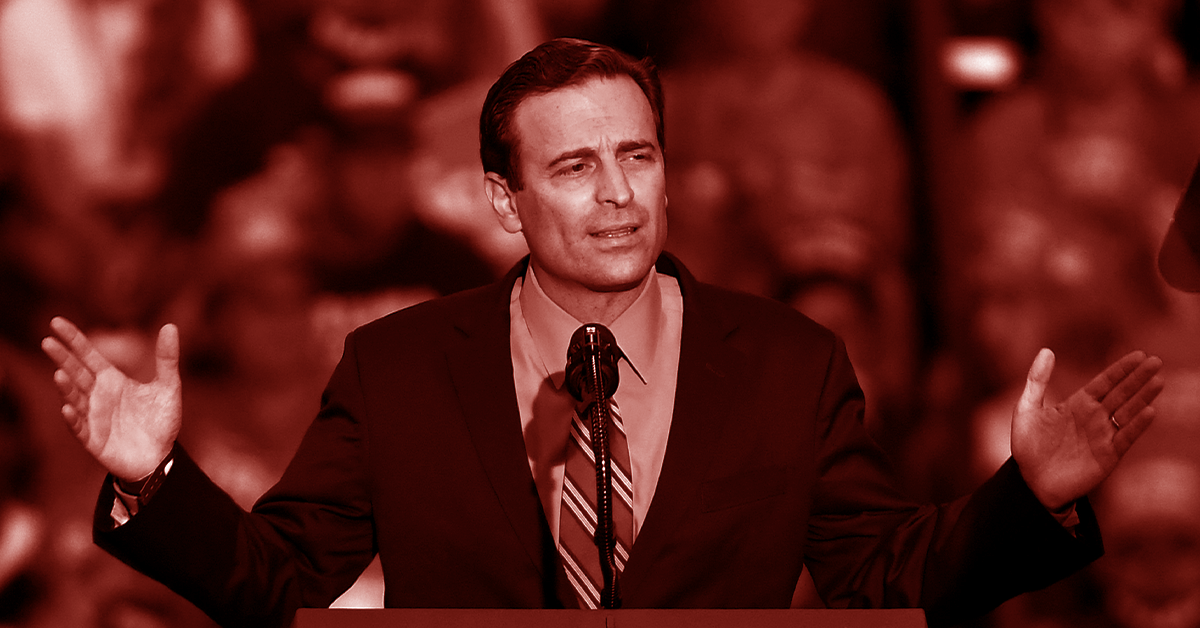

A new report from the American Independent highlights that Nevada Republican U.S. Senate candidate and corporate special interest advocate Adam Laxalt’s household owns up to $305,000 in Big Pharma stocks while he declines to support reforms that will lower drug prices for Nevadans.

Laxalt has personally refused to support Democratic plans to give Medicare the authority to negotiate lower prescription drug prices for Nevadans. And his stock holdings suggest that he has a vested interest in drug companies keeping prices high and maximizing their profits.

Laxalt is running with support from the likes of Mitch McConnell and Club for Growth — staunch opponents of drug price negotiation that have routinely sided with Big Pharma at the expense of consumers.

American Independent: GOP Senate candidate with stock in Big Pharma opposes drug pricing reform

By Josh Israel, 12/16/21

Key Points:

- “A top Republican Senate candidate in Nevada has refused to back a Democratic plan to reduce prescription drug costs. His newly released personal financial disclosures suggest doing so might hurt his own bottom line.”

- “The pharmaceutical industry fiercely opposes the lower drug price provisions in the plan.”

- “Laxalt’s mandatory personal financial disclosure statement, filed Monday and first spotted by the progressive research group American Bridge 21st Century, suggests he and his wife might also stand to lose money if drug companies make smaller profits.”

- “According to the statement, Adam and Jaime Laxalt own stock in six separate pharmaceutical companies, including Amgen, Gilead Sciences, GlaxoSmithKline, Johnson & Johnson, Merck & Co., and the Walgreens Boots Alliance. Though the forms only require candidates to indicate a range of asset values, the couple’s holdings in these companies total somewhere between $67,011 and $305,000.”

Read the full report here.

###

Published: Dec 16, 2021 | Last Modified: Jan 4, 2022